I can’t think of anything that excites a greater sense of childlike wonder than to be in a country where you are ignorant of almost everything. Suddenly you are five years old again. You can’t read anything; you have only the most rudimentary sense of how things work, you can’t even reliably cross a street without endangering your life. Your whole existence becomes a series of interesting guesses. – Bill Bryson, Best-selling author

While living abroad can be one of the most exciting phases in a person’s life, it comes with its own set of challenges – cultural, social, legal, and regulatory. In this edition, we focus on the legal and regulatory aspects – these can be daunting, and a slight mistake can put you in serious trouble.

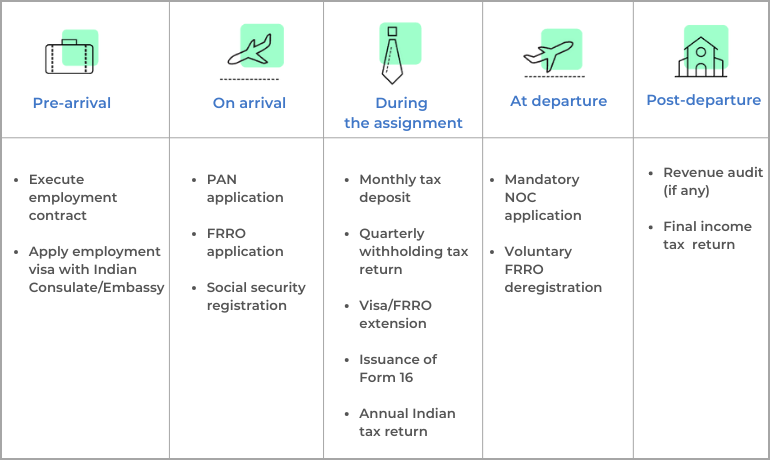

For ease of understanding, we have divided the legal compliance structure into 5 different stages –

1. The pre-arrival stage

Yes, your legal prep begins even before you start packing your bags to India. This stage essentially involves checking that your documents, such as the secondment letter, certificate of exemption from Indian social security and visa application form are in place.

2. The arrival stage

Within a fortnight of your reaching India, you and your family need to register with Indian immigration authorities (FRRO registration). You also need to register with India’s social security authorities, file your application for a unique tax identification number, commonly referred to as Permanent Account Number (PAN) and most importantly setup your Indian bank account.

3. During the assignment

The most number of compliances are to be met at this stage. Based on the number of days you have spent in India your tax residency is determined. This is crucial in determining taxability of your overseas income in India. You must mandatorily file your annual income tax return by 31st July of the following tax year. The form involves serious number crunching and interpretation of complex tax laws.

Don’t forget to keep an eye on that visa. You need to get it renewed /extended each time well before it expires.

Your employer also has a lot of compliances to follow throughout your secondment term – running your payroll, withholding monthly taxes and filing quarterly return forms for the same, contributing to your social security fund, issuing you annual withholding tax certificates etc.

4. The departure stage

You enjoyed your stay in India, both professionally and personally (or so we hope), and now the time has come for you to leave the country. Before you part, you need to take a no-objection certificate from the tax authorities compulsorily. You may also choose to deregister yourself with the immigration authorities.

5. The post-departure stage

Once you have left India, you need to withdraw money saved as part of the social security scheme here, and file a final tax return with the tax authorities. Later on, you may need support with any tax queries/ assessments raised by the Indian tax authorities.

Quick glance through the assignment stages

We understand all this sounds intimidating. But all this is exactly what we, at Expat Orbit, specialise in. No, not intimidation. We specialise in expatriate tax, global mobility services, and in helping expats like you overcome legal and regulatory complications with ease. From a pre-arrival counselling to a farewell counselling, we make sure we are with you every step of the way.

As for the cultural and social challenges, Expat Orbit fully understands the roller coaster ride you are on. One moment you are relishing your time here. The next moment you want to pack up and go back home. To help you navigate your way in a new country, we organise everything from accommodation and commuting to language and cultural workshops. And in all of this, our only aim is to make this alien country so warm and comfortable that you start calling it home.

In case there is anything you want to ask about your stay in India, just click on the link, and schedule a complimentary meeting with Expat Orbit’s team of experts. We would be more than happy to help you in whatever way we can.