Hiring Expats in India: Challenges and Solutions for Global Companies

Companies worldwide are increasingly looking beyond borders to hire expatriates for specialized roles. Hiring expats in India is a significant aspect of this trend, reflecting the growing demand for international talent in the region. While some businesses have formal mobility programs to manage these transitions, others, particularly those that may not frequently employ expatriates, often hire expats directly without such structured frameworks in place.

This article examines the experiences of expatriates who manage their international relocations independently - often referred to as "DIY expats" - while exploring practical approaches that can help create successful working relationships between such expatriates and their employers.

Case studies of Thomas, an expat benefiting from a formal mobility program, and Tanaka San, a directly hired expatriate, illustrate the contrasting experiences within these frameworks.

Thomas' Experience: Secondment Under a Mobility Program

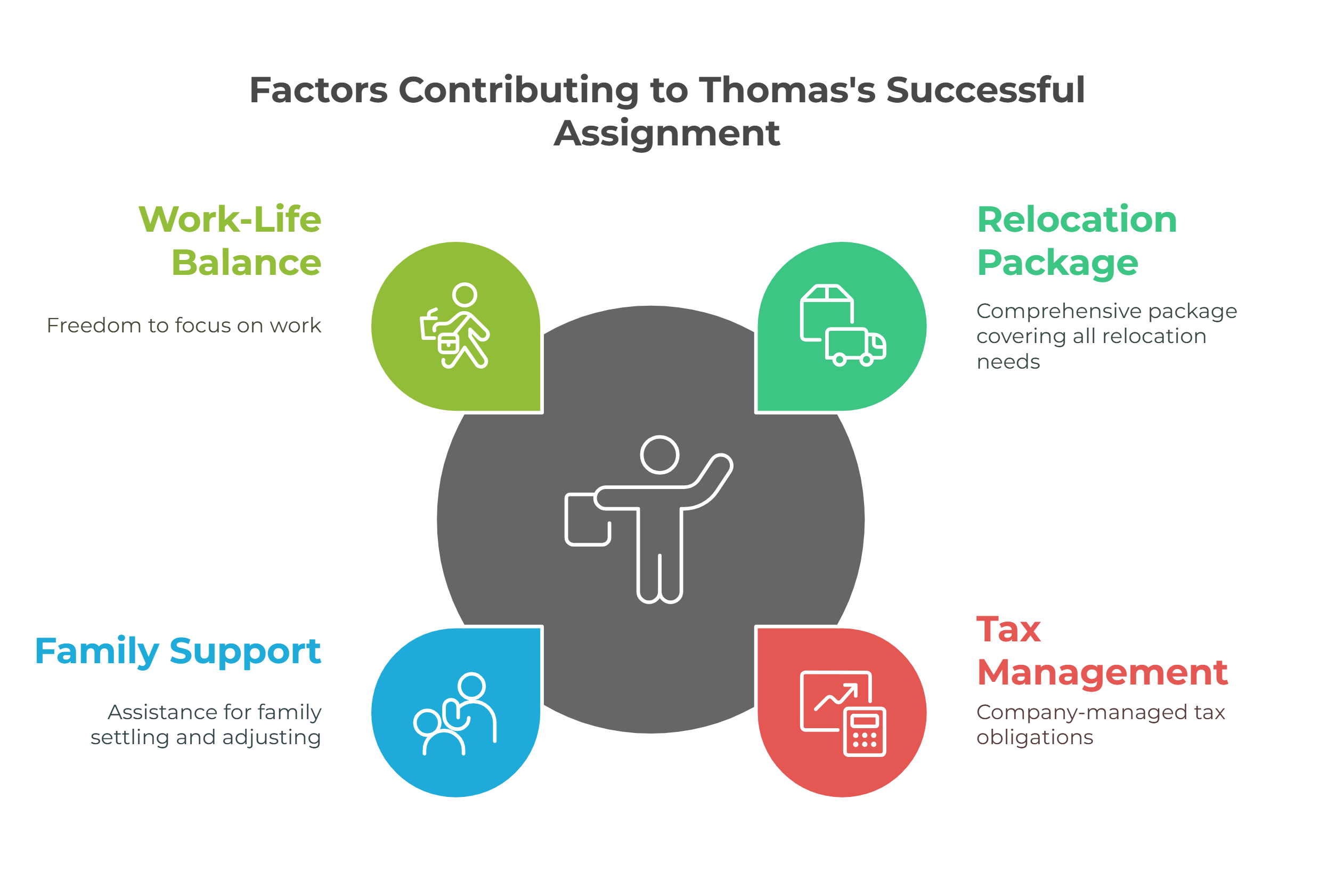

Thomas, an expatriate from the U.S., was seconded to India by ABC Inc. under a comprehensive mobility program, which facilitated a seamless transition and successful assignment. The structured support provided by the company included several key advantages:

- Complete Relocation Package: All legal, financial, and logistical aspects of Thomas's assignment were established in advance. His expatriate package encompassed housing, educational provisions for his children, family support, and cultural counseling.

- Hassle-free Tax Management: The company handled all tax equalization and social security obligations, protecting Thomas from unfamiliar tax burdens in India.

- Family Settlement Support: Full assistance with relocation, accommodation in a desirable locality, and cultural adjustment counseling for the entire family.

- Work-Life Balance: With ABC Inc. managing administrative and logistical challenges, including tax filing support, Thomas could concentrate entirely on his work responsibilities.

This well-structured framework minimized potential disruptions and helped avoid common pitfalls such as lost productivity or early assignment termination due to tax-related stress or cultural adjustment difficulties, creating a productive environment for both Thomas and ABC Inc.

Click here to learn more about what a well-designed expat assignment should encompass.

Tanaka San’s Experience: Direct Hire by an Indian Company

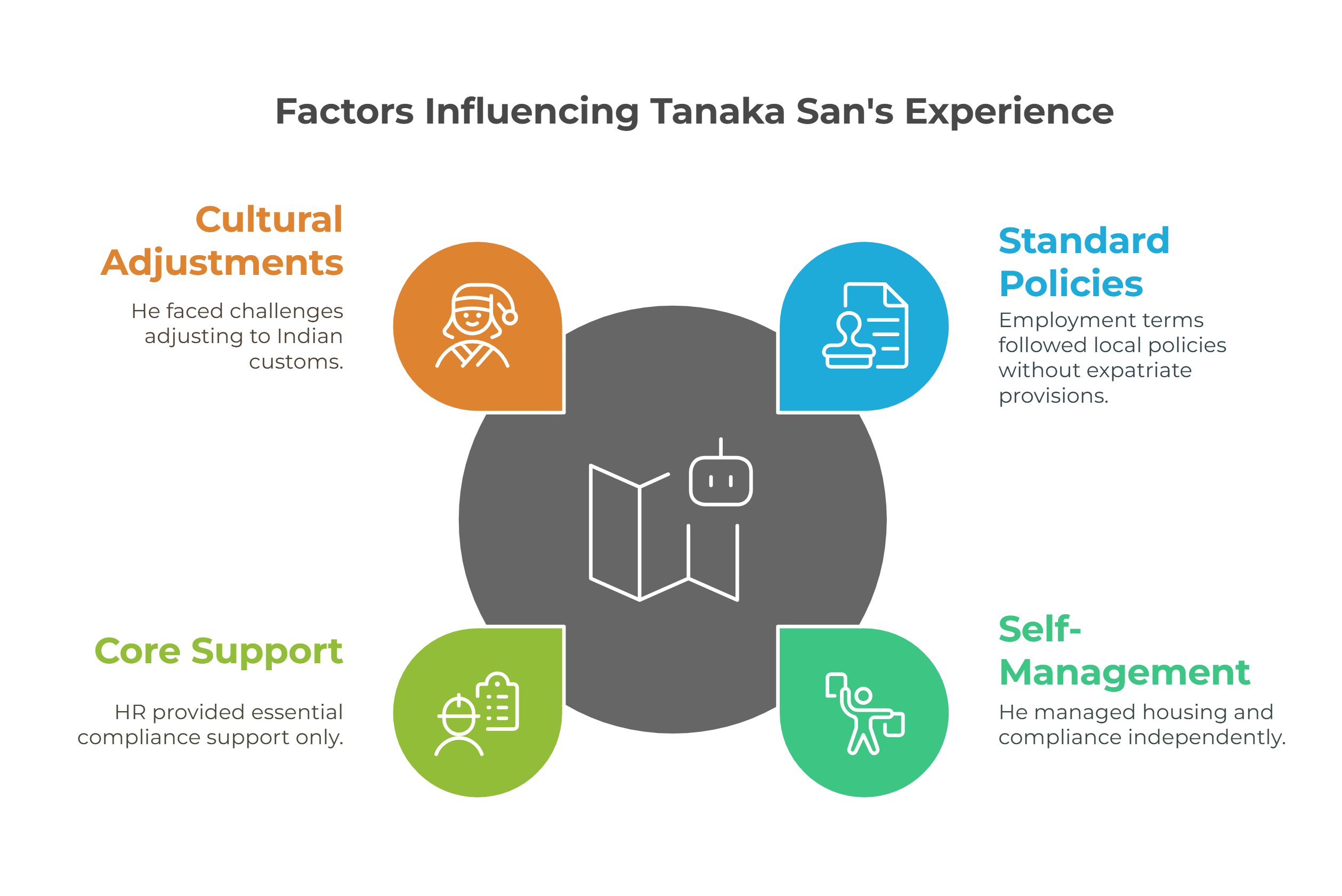

Tanaka San, a Japanese national, was directly hired by a Gujarat-based manufacturing company for a specialized project. His experience highlights the common challenges faced by expatriates in organizations without established mobility frameworks:

- Standard Local Policies: While offered a competitive salary, Tanaka San's employment terms followed standard local policies rather than specialized expatriate provisions. This meant navigating many aspects of his relocation independently.

- Self-Management of Housing and Compliance: Without a formal relocation package, Tanaka San was responsible for managing his own housing arrangements and navigating tax filings and compliance obligations. This proved challenging, as he was unfamiliar with the Indian tax system and local real estate market.

- Core Support Only: The company's HR team assisted with essential compliance requirements—visa processing, FRRO registration, and mandatory tax deposits—but broader logistical and personal matters remained Tanaka San's responsibility.

- Cultural and Lifestyle Adjustments: Adjusting to Indian customs and lifestyle proved challenging for Tanaka San. Though the company provided support within its existing framework, the absence of formal cultural orientation or comprehensive relocation assistance impacted his transition experience.

This case demonstrates how companies with limited expatriate populations often lack comprehensive mobility infrastructure. While Tanaka San received basic support within the company's capabilities, a more structured approach to cultural adjustment and logistical management could have significantly enhanced his expatriate experience.

Read 5 stages of compliance for an expatriate in India

Challenges for Companies and Expatriates Under the DIY Expatriate Program

Companies that directly hire expatriates like Tanaka San often prioritize delivering competitive compensation and fulfilling employer related obligations. However, without a structured mobility program, certain challenges may arise:

- Tax Compliance Complexity: Expatriates struggle with complex international tax obligations, often misunderstanding cross-border tax implications and treaty provisions. The lack of proper tax guidance can lead to compliance errors and unexpected tax liabilities, affecting both the expatriate's finances and the company's regulatory standing.

- Cultural and Social Integration: Expatriates often face significant challenges in adapting to new cultural environments. Language barriers, unfamiliar social norms, and isolation can impact their work performance and personal well-being, potentially leading to decreased productivity and job satisfaction.

- Regulatory Risk Exposure: Companies face heightened compliance risks when managing expatriate employment without structured frameworks. Missing immigration deadlines, mishandling visa requirements, or incorrectly assessing tax residency can result in serious consequences, including corporate penalties and potential expatriate deportation.

- Financial Impact of Failed Assignments: Early termination of expatriate assignments due to adjustment difficulties or inadequate support creates substantial financial burden. With international assignments costing 2-3 times more than local positions, premature departures result in significant losses through recruitment costs, project delays, and replacement expenses.

Addressing the Gaps: Solutions for Directly Hired Expats

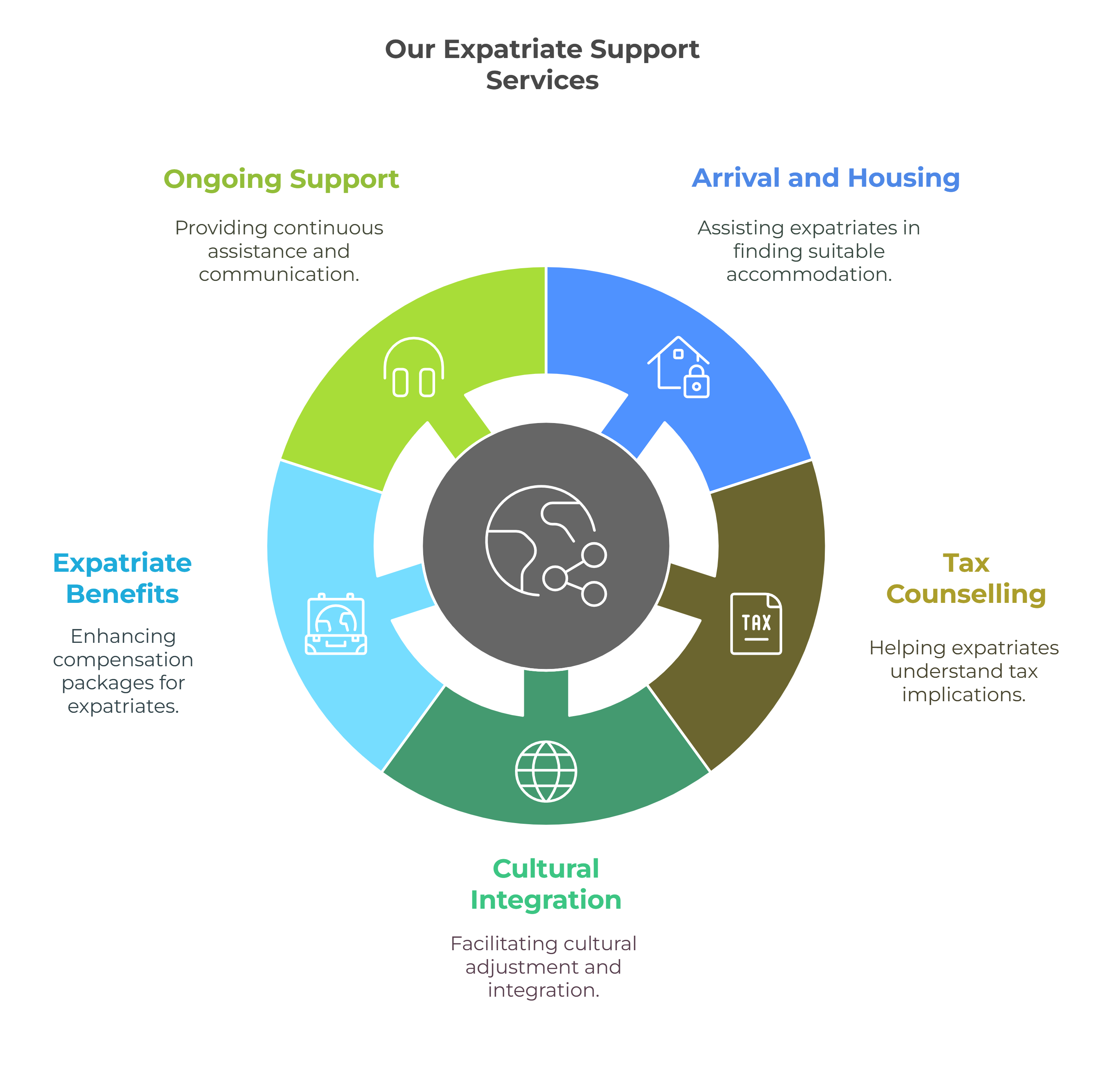

While formal mobility programs may not be feasible for all organizations, companies can implement targeted support measures to enhance their expatriates' experience and success. Here are key areas to focus on:

- Arrival and Housing Support: Assist expatriates in finding suitable accommodation in safe neighborhoods with access to essential amenities like medical facilities, schools, and public transportation. Early guidance on local housing markets and rental practices helps ensure a stable foundation for the assignment.

- Tax Counselling: Provide general counselling sessions to help expatriates understand basic tax implications of their international assignment, including available exemptions and treaty benefits. This helps them make informed decisions about their personal tax planning while working abroad.

- Cultural Integration: Facilitate adjustment through language classes and cultural orientation. Supporting participation in local festivals, community events, and cultural workshops helps expatriates and their families build connections and understand local customs.

- Expatriate-Focused Benefits: Enhance standard compensation packages with targeted benefits such as international school fees support, housing allowance, home leave travel, and language training support to address unique expatriate needs.

- Ongoing hand-holding support: Maintain regular communication channels to address ongoing needs and challenges. Regular check-ins and structured support mechanisms help identify and resolve issues before they impact assignment success.

Companies with regular expatriate hiring practices should consider establishing a robust global mobility policy. A well-structured mobility framework creates consistency across international assignments while setting clear guidelines for benefits and support. This streamlines hiring processes, reduces compliance risks, and strengthens the company's ability to attract international talent. Developing such a policy sets a strong foundation for managing future expatriate assignments efficiently.

Conclusion

The key to managing expats successfully lies not just in premium compensation but in providing structured support that can ease their transition into a new country. Professional guidance from experts such as Expat Orbit can help bridge the gap, ensuring that both the employer and the expatriate benefit from a well-managed, compliant, and supportive work arrangement.

Overlooking the importance of proper support for expatriates can jeopardize even the most robust compliance efforts.