Activities permitted for Representative Offices in India – Do’s and Dont’s

India continues to attract global businesses exploring expansion opportunities in a high-growth, regulated market. However, not every company is ready to set up a full-fledged Indian subsidiary on day one. Many prefer a low-footprint model that allows them to test the waters, build connections, or execute limited operations, without forming a separate legal entity.

This is where representative offices come in.

Foreign companies can establish three primary types of representative offices in India:

- Liaison Office (LO)

- Branch Office (BO)

- Project Office (PO)

These offices are not separate companies but just extensions of the foreign parent. They are governed by the Reserve Bank of India (RBI) under the Foreign Exchange Management Act (FEMA), and are permitted to operate only within the scope of specific, pre-approved activities. This makes them fundamentally different from an Indian subsidiary, which is an independent legal entity with broader operational powers. Because these offices operate within a tightly defined regulatory framework, it's critical for companies to understand what they are allowed to do and what crosses the line into non-compliance.

In this article, we’ll break down the permitted activities for LOs, BOs, and POs, and provide a clear Do's and Don'ts guide to help you navigate India’s regulatory environment with confidence.

Representative Offices in India - Overview

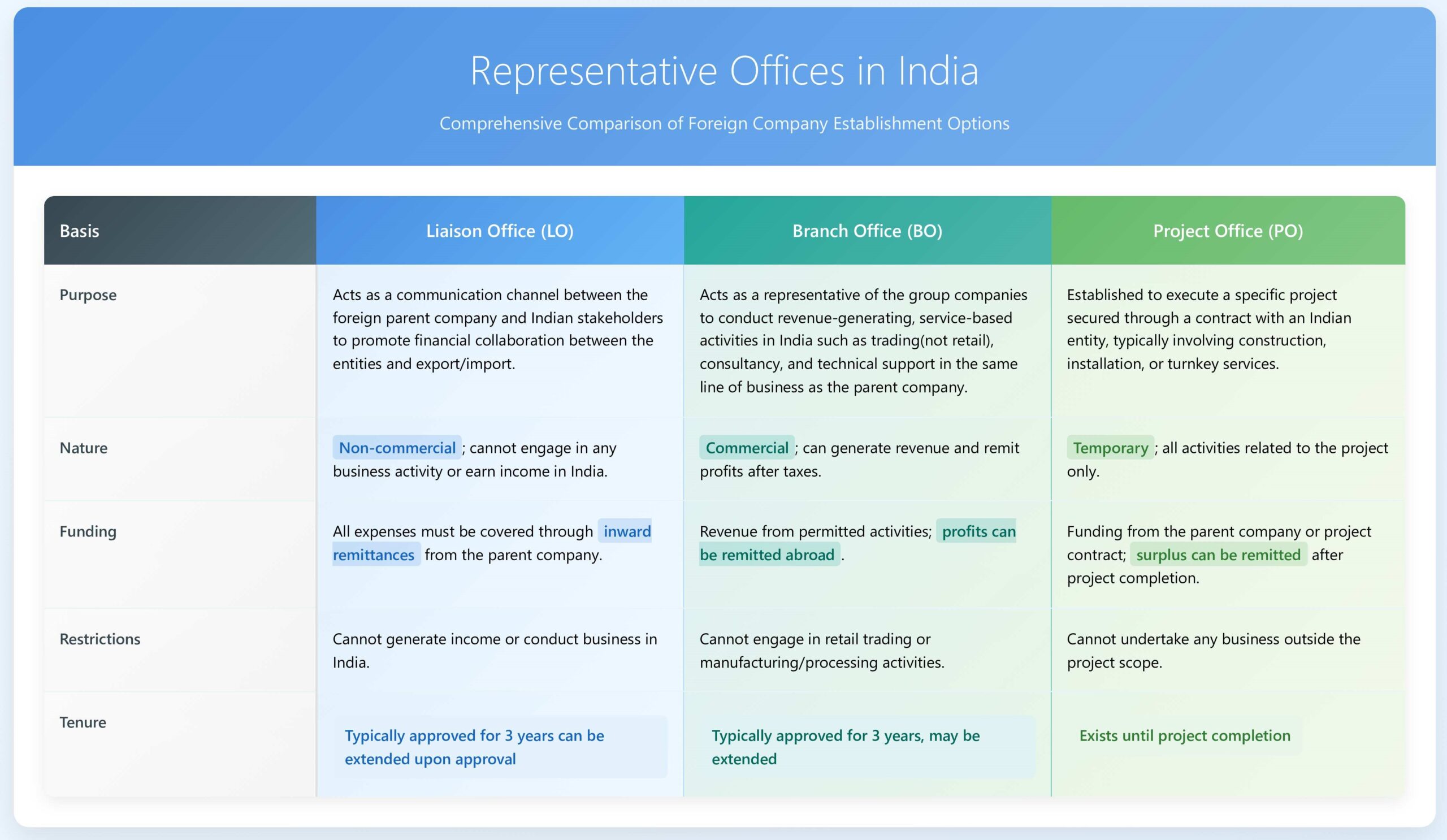

The choice between a liaison office, branch office, or project office is dictated by the nature of activities the company intends to undertake in India. Below is a overview at a glance comparing the three offices:

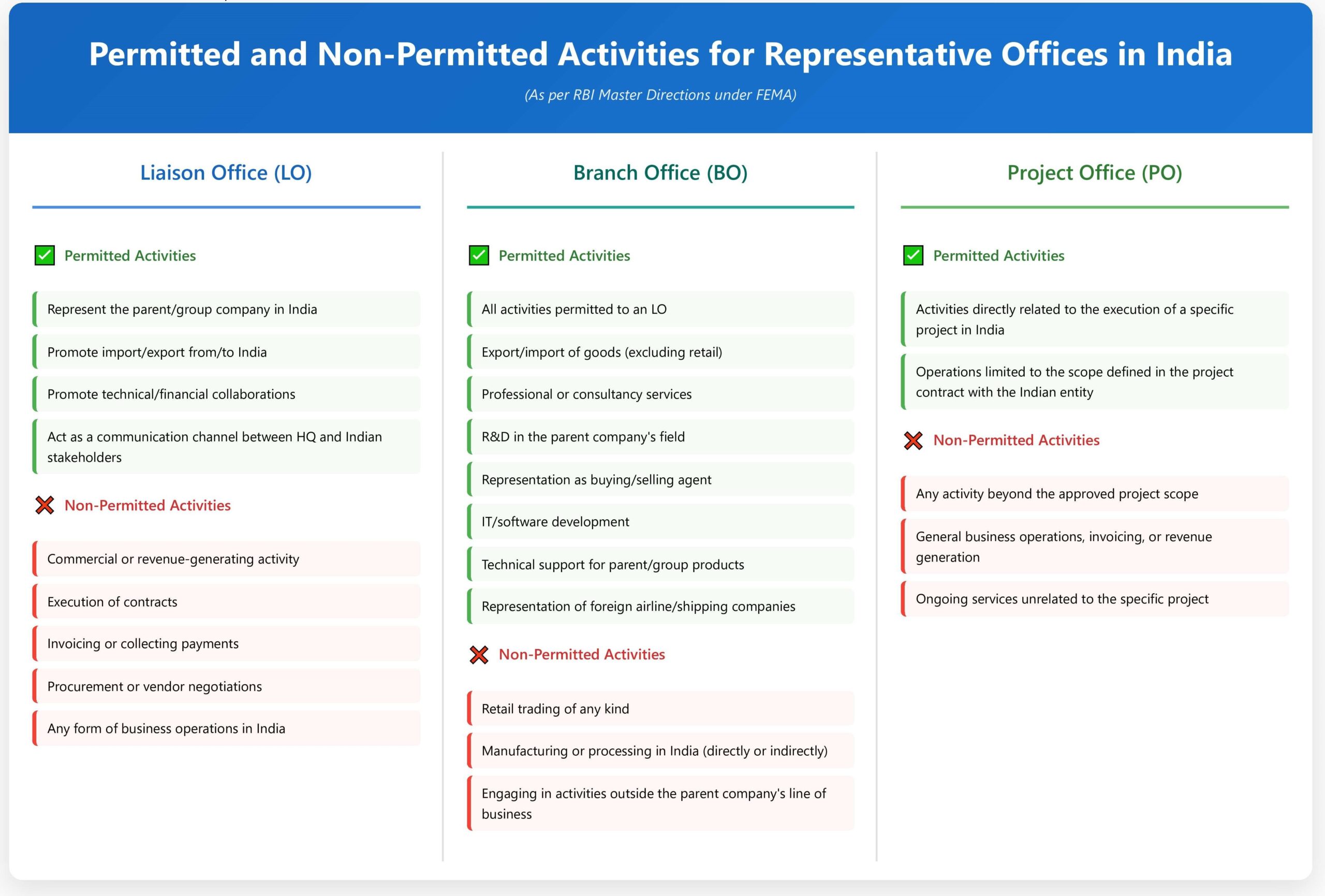

Permitted Activities: Liaison Office V/s Branch Office V/s Project Office

Conclusion

Setting up a Liaison Office, Branch Office, or Project Office in India can be a strategic way for foreign companies to enter the Indian market with a lighter footprint. However, each structure comes with clearly defined boundaries under RBI’s FEMA guidelines and crossing those lines, even unintentionally, can lead to regulatory or tax consequences.

Before choosing a representative office model, it’s important to match your business intent with what’s actually permitted under law. Whether your goal is market research, service delivery, or executing a time-bound project, understanding the “do’s and don’ts” of each office type is crucial for staying compliant.

At Expat Orbit, we don’t just do the papework, we help you evaluate which model best aligns with your vision, business objectives, and compliance requirements. From RBI approvals to ongoing filings and expat support, we guide your team through the entire lifecycle.