Annual Filing Requirements for Representative Office in India

For foreign companies operating in or planning to set up a representative office in India, the road doesn’t end with initial approvals and registrations. After managing the procedural rigour of establishing a Liaison Office (LO), Branch Office (BO), or Project Office (PO), what follows is non-negotiable compliance responsibilities. While these offices are not separate legal entities but just extensions of the overseas parent company, this itself makes the regulatory filings essential to demonstrate transparency and adherence to the Indian law. Annual filings are a core part of this framework and serve as a declaration that the office remains within its permitted scope of activity. Missing deadlines or filing incorrect information can attract penalties, scrutiny, or even cancellation of RBI approvals.

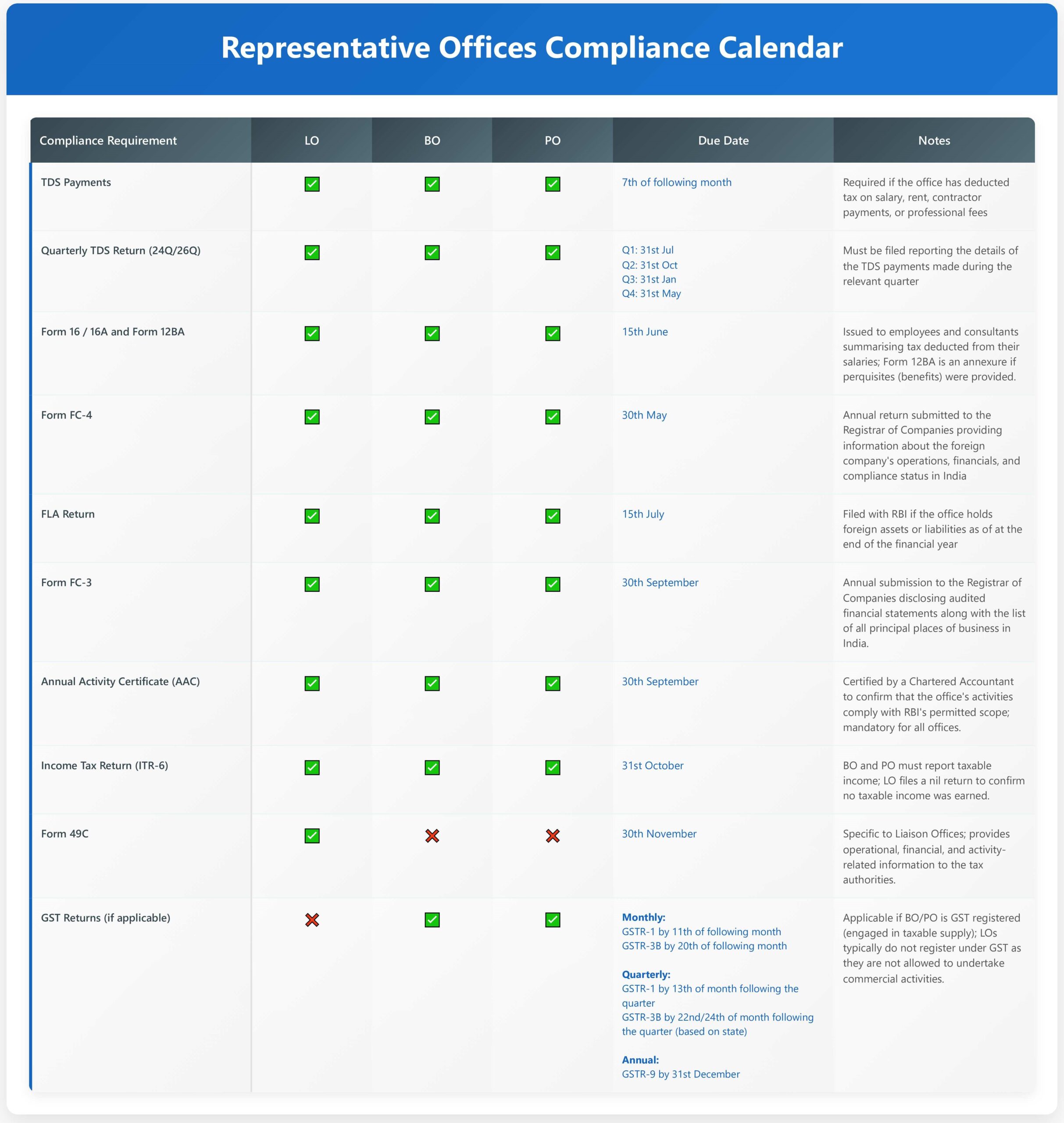

This article outlines the key filing requirements for each office type, followed by a consolidated compliance calendar and practical tips.

Key Annual Filing Requirements for Representative Offices

Regardless of the type—Liaison Office, Branch Office, or Project Office—representative offices in India are subject to various regulatory filings. These span across reporting of annual activities, financial transactions, tax compliance, and statutory registrations. Each filing has a specific purpose and must be submitted to a designated authority within a defined timeline.

Here are some of the most important annual filing requirements applicable to representative offices:

Filing Matrix for Representative Offices

The filing requirements may vary based on the office structure. Each type of office is subject to specific regulatory obligations depending on the nature of its permitted activities, commercial presence, and tax exposure in India. The following comparative table provides a consolidated view of the applicability of key compliances across these office types:

Beyond the filing requirements discussed above, teams must also carefully manage expatriate-specific compliances like: Visa and FRRO renewals, Monthly tax withholding calculations and Payroll processing for expatriates and local employees, Tax clearance and exit formalities at the end of an assignment. These add an extra layer of complexity, especially when multiple regulatory touch points converge across HR, finance, and compliance functions. For many teams, this can quickly become overwhelming, particularly when day-to-day operations are already lean or focused on core business priorities.

Employer of Record: An Alternative Solution

In some cases, companies find that transitioning to an Employer of Record (EOR) arrangement can help ease this administrative burden, especially when there is only a small team for market research or project execution. An EOR allows foreign businesses to continue employing talent in India without any need of entity or office set up. The EOR becomes the legal employer on record, managing local payroll, tax compliance, and statutory filings, while the foreign company retains full control over day-to-day work and deliverables.

While this model may not be a right-fit for all such as branch offices engaged in trading of goods, it can be highly strategic solution for foreign companies to undertake activities like market research, business development, project management and coordination or business promotion through deploying their team (local or foreign) under the EOR model, saving significant time and cost.

At Expat Orbit, we support gloabal companies throughout the lifecycle of their India presence—from managing regulatory filings and expatriate compliance, to enabling seamless employee transitions under the Employer of Record (EOR) model. Whether you’re looking to stay fully compliant while operating a representative Office, or want to explore if an EOR is the right next step to retain your Indian team, we’re here to help you provide the best solution. If you’d like to discuss your options or need tailored support for your India strategy schedule a call here.