Closure of Representative Offices in India

For many foreign companies operating representative offices in India, there eventually comes a natural closure point in their India journey. This may arise for a variety of reasons:

- Project completion (for POs),

- Strategic realignment within group entities,

- Regulatory or compliance burdens,

- A shift to more flexible market-entry models,

- Or simply the successful fulfillment of the original purpose for which the office was set up.

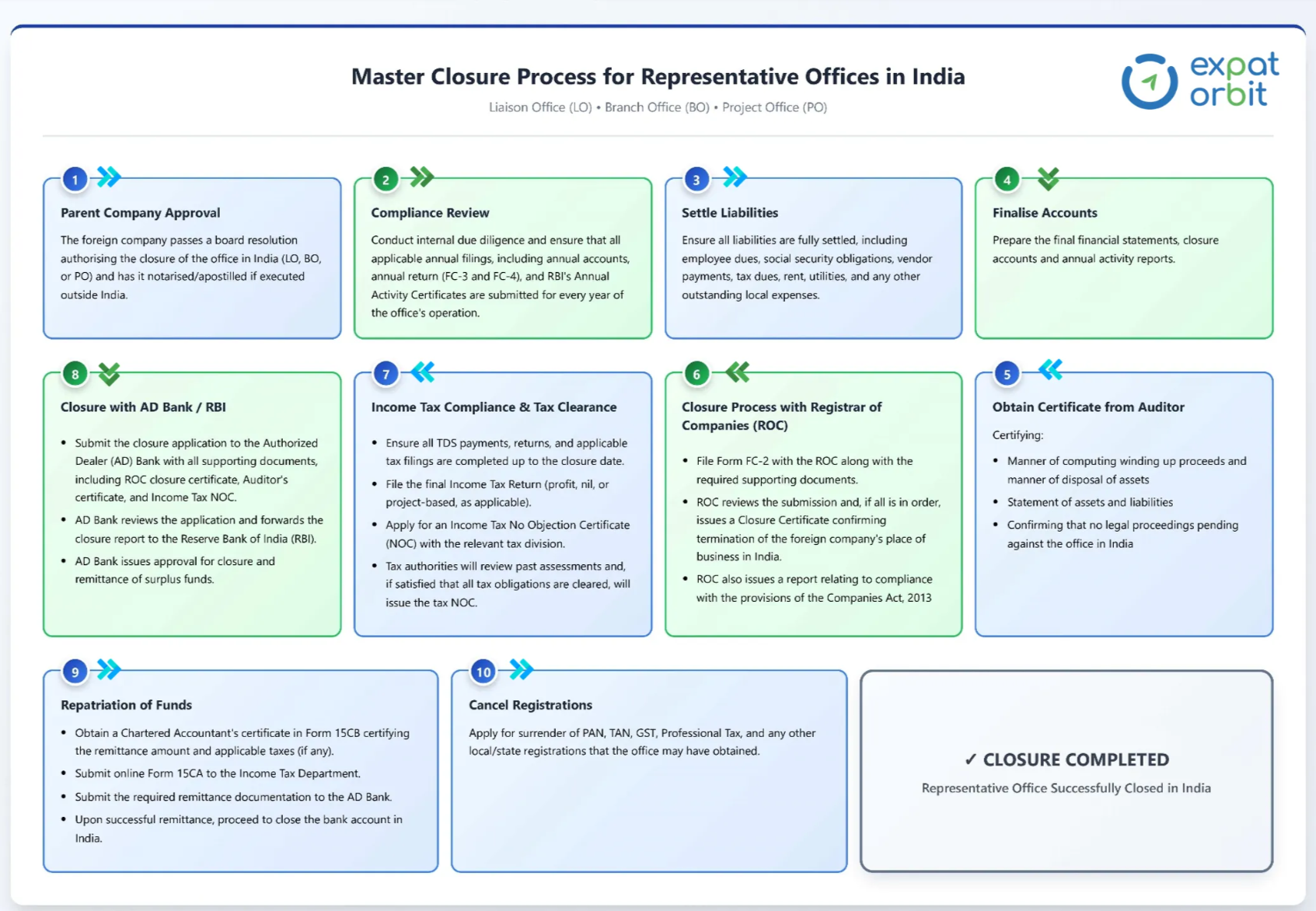

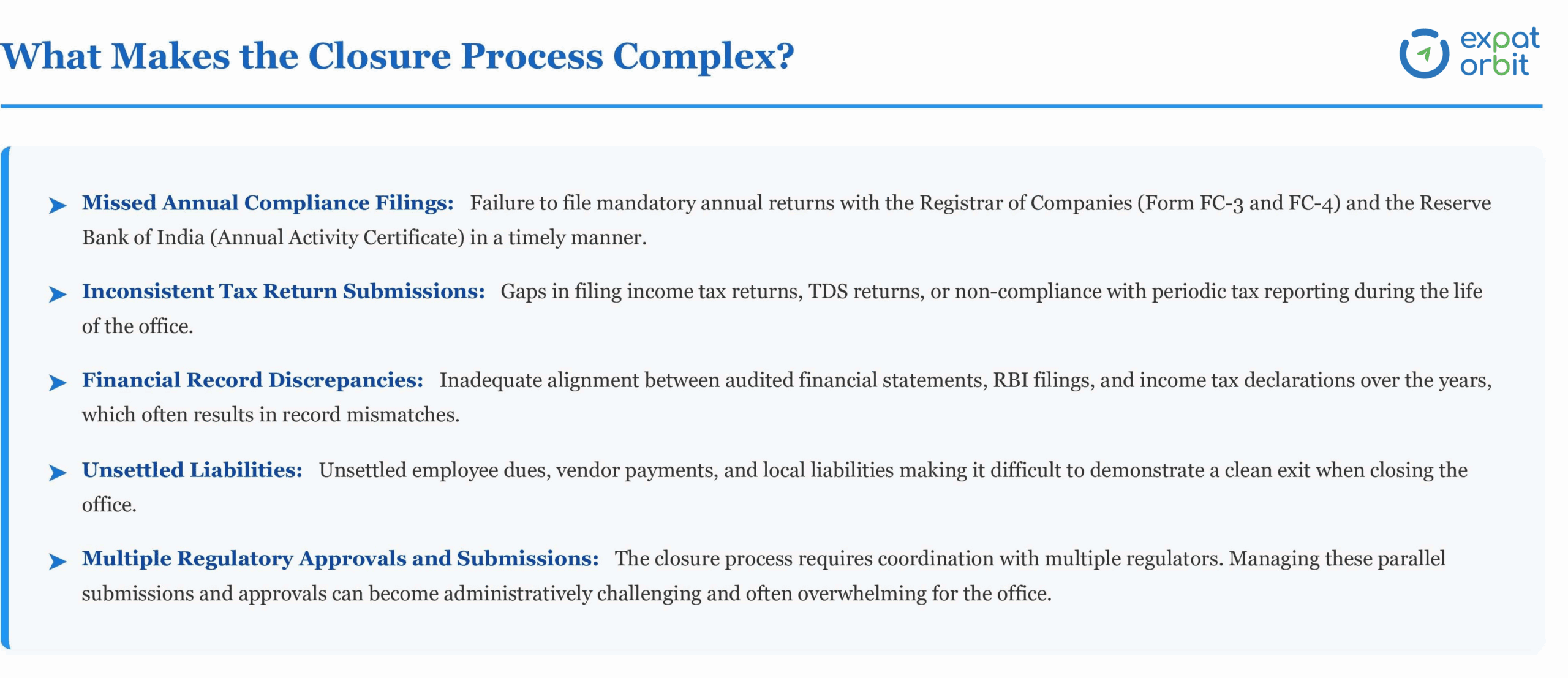

Regardless of the reason, closing a representative office in India is not an instant administrative step. It is a multi-layered process that involves careful sequencing and coordination with multiple regulators such as the Reserve Bank of India (RBI), Ministry of Corporate Affairs (MCA), Income Tax Department, and the designated Authorised Dealer (AD) Bank.

While the detailed closure process shall vary based on the industry and the specific business operations of the foreign company, this article aims to provide a high-level overview of the core steps typically involved in closing a representative office in India.

Below is step-by-step guide for winding up a representative office in India, presented through a Master Closure Flowchart that outlines the key steps applicable to all representative office types.

Note: It is important to note that certain industries such as foreign banks, insurance companies, Non-Banking Financial Companies (NBFCs), and entities from countries with specific RBI restrictions, may have additional sector-specific procedures or approval requirement from authories like Insurance Regulatory and Development Authority and Department of Banking Operations and Development.

While the closure process for Liaison Offices (LO), Branch Offices (BO), and Project Offices (PO) broadly follows the same regulatory pathway and sequencing of steps, the documentation requirements, financial scrutiny, and regulatory attention shall vary based on the type of office and its financial activities in India.

For instance, a Liaison Office, which is not permitted to earn income in India, typically undergoes a simpler tax and financial closure process. In contrast, a Branch Office with commercial operations must manage detailed tax settlements, asset disposals, and the closure of customer contracts. Similarly, Project Offices often require project-specific documentation, asset transfers, and sectoral approvals depending on the scope and nature of the project.

Key Checkpoints

- Ensure that all statutory filings and regulatory compliances for previous years have been completed and there are no outstanding non-compliances.

- Conduct internal due diligence to review the current compliance status, pending filings, outstanding tax demands, ongoing litigation, and any unresolved regulatory matters prior to closure applications.

- All employee contracts must be formally terminated and all dues such as salaries, bonuses, social security and any other outstanding obligations towards employees must be fully settled.

- During the closure process, authorities may request additional documents, clearances, or undertakings specific to the office type or sector. Proactively preparing for these requirements can expedite approvals.

- All closure-related documents must be duly signed and executed by the authorised signatory. If any document is executed outside India, it must be notarised and apostilled.

Post-Closure Challenges – What If You Still Need a Local Team?

We often work with global firms who want to exit their representative office due to end of license validity or compliance complexity, but still need:

- A local team for market intelligence or business development,

- A few specialists to continue research or coordination with foreign entity,

- Continuity in Indian operations without keeping a formal office.

This is where Employer of Record (EOR) comes in.

An EOR allows foreign companies to retain staff in India without maintaining an entity or representative office. The EOR becomes the legal employer of the team, handling:

- Employee onboarding & contracts

- Monthly payroll & tax compliance

- Social security, labour law, and regulatory filings

Meanwhile, the foreign company retains operational control over tasks, deliverables, and reporting, without worrying about any entity-level or employer obligations.

Expat Orbit has supported such foreign companies in leveraging the EOR model as a preferred exit+continuity strategy in India. One such example is a Japanese multinational company we are currently supporting. The company has closed its Indian office but continues to retain both local and Japanese employees in India to support critical operations. Through the Employer of Record (EOR) model, we are seamlessly managing their payroll, tax compliance, and employee administration, while the client retains day-to-day operational control over their team’s work. This solution has allowed them to exit their formal Indian entity while continuing business operations without disruption.

Read the full case study to see how this model was implemented in practice.

Conclusion

Shutting down a representative office in India requires planning, coordination and timely filings with multiple authorities. But with the a clear roadmap, the process can be managed efficiently.

And if you're considering a softer exit, transitioning to an EOR model with Expat Orbit can help you retain your India presence, without the overhead of an LO, BO, or PO.

Need help mapping out a closure timeline or exploring EOR?

Reach out to us at [email protected] or schedule a call with our experts. We’re here to simplify your India strategy.