From exorbitant costs to administrative hassles: 6 challenges to setting up entity in India

Would you want to get married first and then date the person and know more about them? Or first, date them, see if things are working well then make the bigger commitment of setting up a home together and finally get married.

Setting up an entity in India, or any country for that matter is no different than getting married to someone.

Is getting married challenging? Not if you are getting married to the right person.

Is setting up an entity in India challenging? Not if you’ve done a compatibility test first (and passed it too).

How do you perform a compatibility test? Using our Employer of Record (EOR) service.

What’s an EOR? We’ll come to it later.

First, let us illustrate why marr…. setting up and managing an entity in India is no child’s play.

6 challenges to setting up entity in India

1. Setting up process and time -

Setting up a subsidiary involves abiding by multiple Acts, Rules, and guidelines -

Companies Act, 2013, Companies (Registration of Foreign Companies) Rules, 2014, RBI guidelines, SEBI guidelines, and Foreign Exchange Management Act. Generally, Foreign Direct Investment (FDI) is open in most sectors, however, there are a few sectors where approvals are required while in some sectors, FDI is not permitted at all.

There are multiple procedures and norms to be followed, such as, having a minimum of 2 directors with at least 1 director being Indian, registering the company name with the Registrar of Companies, preparing the Memorandum and Articles of Association and filing registration application along with required documents.

Doing all this and more can easily take up to 2-4 months.

2. The long list of registrations and approvals-

To become fully operational, an Indian subsidiary needs to be registered with, and approved by various authorities - register with the Income-tax department and get a Permanent Account Number (PAN) and a Tax Deduction Account Number (TAN), register with India’s social security body, apply for Goods and Services Tax Number (GSTN), take permits and NOCs from various governmental authorities, the list is pretty long.

3. The mammoth infrastructure cost -

You got to set up a physical registered office in India to be recognised as legally present.

Taking up a property on lease, especially in Tier-I and II cities like Mumbai, Delhi, Bengaluru, etc., can cost you both your arms and your legs.

Assuming your business has 10 employees, it would need at least a 400-500 square feet office. Considering that your core team will be operating from your home country, you will either need to set up a separate admin team to take care of all things like housekeeping, security, infrastructure management, etc. Or the sane option is to take up an office in a co-working space. In Delhi that would cost at least Rs 1,00,000 per month in lease rentals for a mere 10 seater office. Setting up an in-house admin team, on the other hand would in itself be a huge cost, which is exclusive of office operational costs like electricity, Wi-Fi, security, housekeeping, etc.

4. The Recurring Compliances -

Just when you are done with one compliance, you have another knocking at your door. There are year-round accounting and auditing obligations for Indian companies - regular Board meetings, statutory and secretarial audits, and employer-related payroll compliance like withholding taxes, social security contributions, etc.

There are strict penalties for missing out on deadlines.

Yes, the cycle is never-ending.

5. Managing human resources

The people who will actually work towards making dreams a reality. Hiring the right people in a foreign land you know nothing about is more complex than you think it is. You need to manage payroll and employee benefits as per local laws and get your new employees aligned with your vision, mission, and values.

The investment is going to be mammoth.

6. Gestation Period - the make or break stage

Once you have spent all that time, money, and effort in legally setting up and running your entity in India, you face the real test - whether your product or service fits the Indian market. You need to build your brand, market your product, scale operations, beat competitors, and keep impressing the Indian consumer.

You thought you’ll get along well with your partner and you are made for each other. But are you really? It won’t be long before you know.

No business which aspires to grow and expand wants to lose out on a skilled, cost-effective talent pool and the huge consumer market India offers. Setting up an entity in India is the ultimate objective - it serves as an extension of the parent company while having limited liability and safeguarding the parent company from potential litigation, among other advantages.

But just like a marriage, setting-up an entity in India (or anywhere else) is a huge commitment.

Can you somehow have the best of both worlds?

- Can the gestation period in India be reduced or eliminated?

- Can the Indian team be recruited and trained prior to entity incorporation?

- Can company philosophies, work culture, expansion goals be pre instilled and acclimatized according to Indian needs?

We suggest you start with a lesser commitment.

Employer of records (EOR) in India

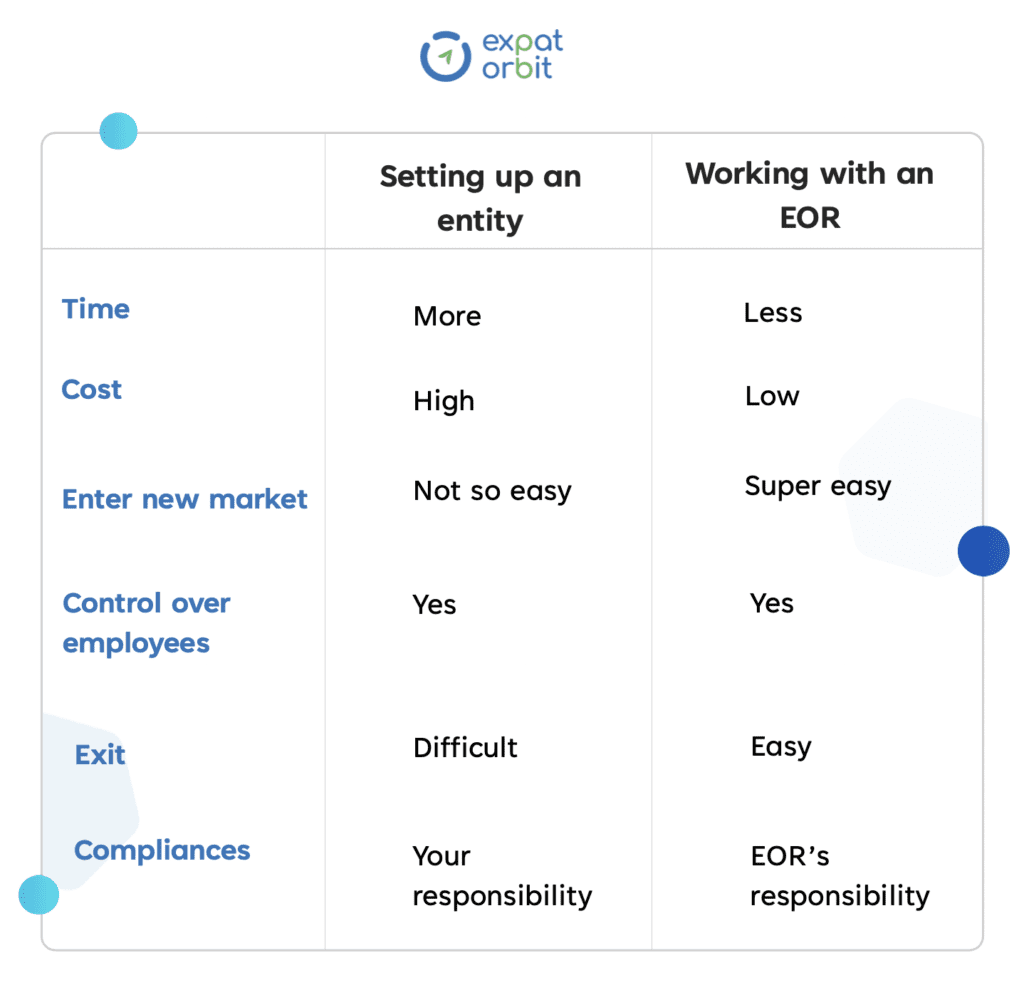

An EOR service provider lets you onboard Indians compliantly while still not having a local entity here.

It assumes the role of the HR department for your remote employees - recruiting, onboarding, and managing them, taking care of employment contracts, and statutory benefits, adhering to local employment, payroll, and compliance laws, and so on.

Expat Orbit advantage

Expat Orbit advantage

- Our EOR services begin at the recruitment stage itself - we help you headhunt the right people,

- With over a decade of working in the arena of Indian employment laws and compliances, our in-house team has become a pro at managing these,

- We can give you insights on localized benefits and other nuances that EORs without a local presence usually miss out on,

- Our pricing is transparent - no hidden costs anywhere, and

- We have a dedicated account manager for all our clients

- Expat Orbit’s EOR services start at only $ 249 per employee per month.

For that money, your startup gets to enter the great Indian market and work with the best talent there is. The cost-benefit analysis seems pretty favorable.

Expat Orbit advantage

Expat Orbit advantage