FRRO Compliance: The Blind Spot Foreign Founders Can’t Afford to Ignore in India

India’s startup ecosystem is rapidly growing. It attracts foreign founders, international advisors, and cross-border teams looking to build and scale quickly. However, amidst the excitement of launching products, securing funding, and expanding markets, one critical area often gets overlooked—immigration compliance, especially FRRO requirements.

Neglecting this can lead to operational disruptions, legal complications, and reputational risks.

The Hidden Risk: Why Fast-Growing Startups Are Vulnerable

Foreign founders and startup teams frequently:

- Enter India on Business Visas, assuming that short trips or frequent re-entries do not create immigration obligations.

- Move swiftly across cities for meetings, product launches, and team-building without monitoring their cumulative stay.

- Rely on co-working spaces and temporary housing where Form C filing the mandatory police notification for foreign nationals is inconsistently managed.

- Fail to consolidate travel records and overlook the growing total number of days spent in India.

What often escapes attention is that immigration authorities track cumulative stays carefully.

FRRO Compliance Requirements You Must Know

For Employment Visa Holders

- FRRO registration is mandatory within 14 days of arrival in India, regardless of intended duration.

For Business Visa Holders

- FRRO registration becomes compulsory if the total stay exceeds 180 days in a calendar year.

- Visa endorsements usually specify this requirement. It is not linked to the financial year.

For Accommodation Providers: Form C Filing

- Hosts, co-working spaces, and temporary housing providers must file Form C within 24 hours of a foreign national’s check-in.

- While submitting Form C at check-out is not legally required, it is a best practice for accurate records.

Note: Registration, visa extensions, and other services can now be processed online through the e-FRRO portal.

Consequences of Non-Compliance

Failure to comply with FRRO requirements can result in:

- Visa cancellation or mandatory departure orders.

- Difficulty obtaining PAN, SIM cards, and opening bank accounts.

- Fines, penalties, and long-term visa restrictions.

- Heightened scrutiny during subsequent entries to India.

For founders and startup teams, this can lead to serious business interruptions, affect hiring plans, and damage investor confidence.

Action Plan for Startup Teams

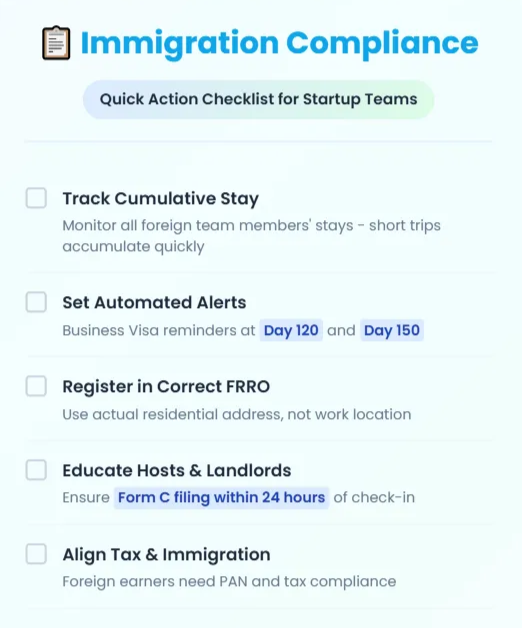

1. Track Cumulative Stay for All Foreign Team Members

Short trips and frequent visits accumulate quickly. Centralized tracking across all founders and key employees is essential.

2. Set Automated Stay Alerts

Automate reminders for Business Visa holders at Day 120 and Day 150 to allow timely planning and registration if required.

3. Register in the Correct FRRO Jurisdiction

Registration must be completed based on actual residential address, not the primary work location.

4. Educate Co-working Spaces and Landlords About Form C Compliance

Hosts must be aware of their obligation to file Form C within 24 hours of check-in.

5. Align Immigration and Tax Compliance

Foreign founders and expatriate employees earning taxable income in India must obtain a PAN and comply with Indian tax return requirements.

Common Misconceptions

Final Takeaway

For fast-growing startups and foreign founders in India, immigration compliance must be a core part of operational planning.

- Integrate FRRO tracking into HR processes and leadership reviews.

- Treat immigration compliance as seriously as tax, finance, or regulatory filings.

- Stay proactive—immigration lapses can be costly and disruptive.

Expat Orbit makes immigration and tax compliance simple for foreign founders in India. Need help managing FRRO, Form C, or visa requirements?

Should you have any questions or need further assistance, click here to connect with our immigration experts.