How do I withdraw my PF from India? Everything a foreign national needs to know.

"How do I get my PF money back from India?" If you're asking this question, you're not alone. Every year, thousands of international professionals like you navigate this crucial final step of their Indian assignment. Having guided countless expatriates through this process, we understand your concerns and are here to help you secure your hard-earned savings.

Summary

Understanding Your PF Rights in India

When you first landed that role in India, Provident Fund might have seemed like just another deduction from your salary. However, these contributions represent significant savings that you're entitled to claim. Since 2008, when India made PF contributions mandatory for international workers, the process has evolved considerably – and we'll help you understand exactly how to navigate it.

Check Your Withdrawal Eligibility First

Your path to accessing your PF savings depends primarily on one factor: whether your home country has a Social Security Agreement (SSA) with India. Let's break this down:

📌 If You're From an SSA Country: Good news! You can withdraw your PF immediately after completing your Indian assignment. SSA countries include:

- European nations: Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Hungary, Luxembourg, Netherlands, Norway, Portugal, Sweden, Switzerland

- Asia Pacific: Australia, Japan, South Korea

- Americas: Brazil, Canada, Quebec

💡 If You're From a Non-SSA Country: The process requires more patience. You'll need to wait until age 58 to withdraw your funds. While this might seem challenging, we'll show you how to maintain your account and documentation effectively during this period.

Your Step-by-Step Withdrawal Guide

To help expatriates take the first step toward PF withdrawal, below is a clear roadmap. There are two main routes to withdraw PF in India: online and offline. The choice depends primarily on your documentation, whether your Indian bank account and mobile number are active, and if your personal details are adequately updated in the Employees’ Provident Fund Organization (EPFO) system.

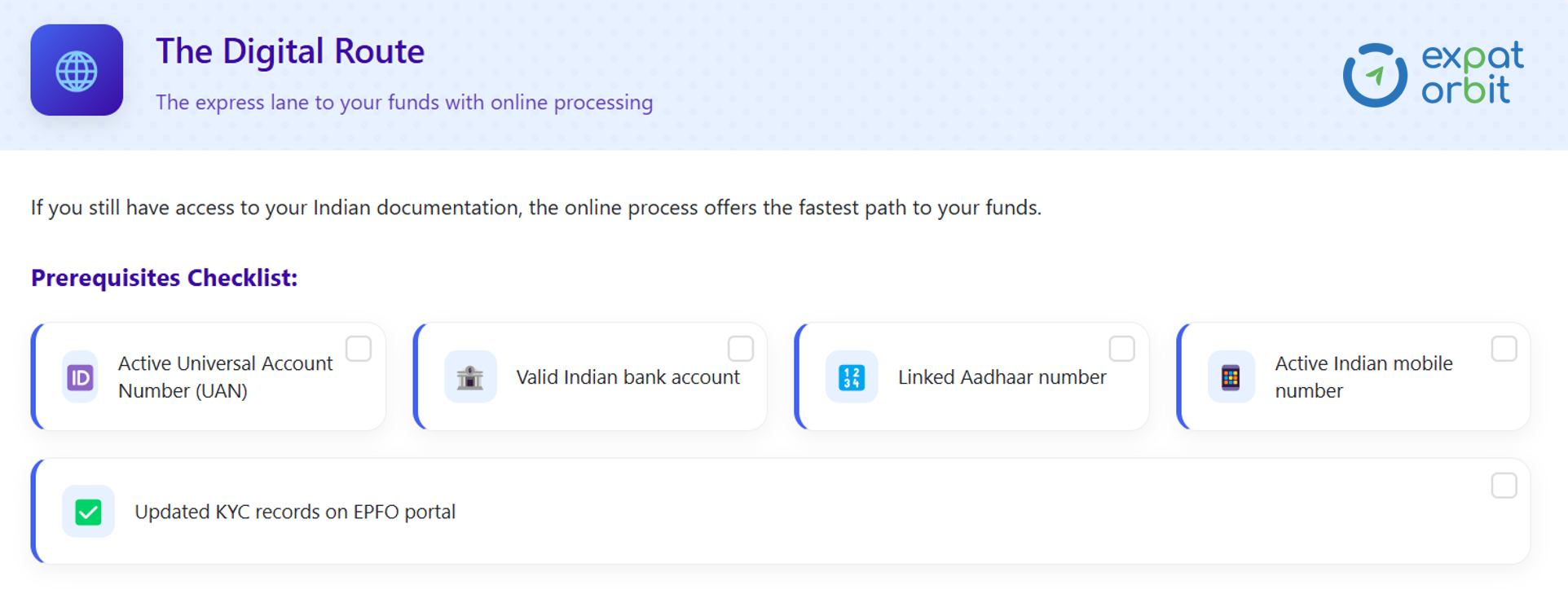

Option 1: The Digital Route (Recommended)

Steps Involved:

- Log into your EPFO account using your UAN

- Navigate to "Online Services → Claims"

- Select Form 19 for PF withdrawal

- Verify your details and submit

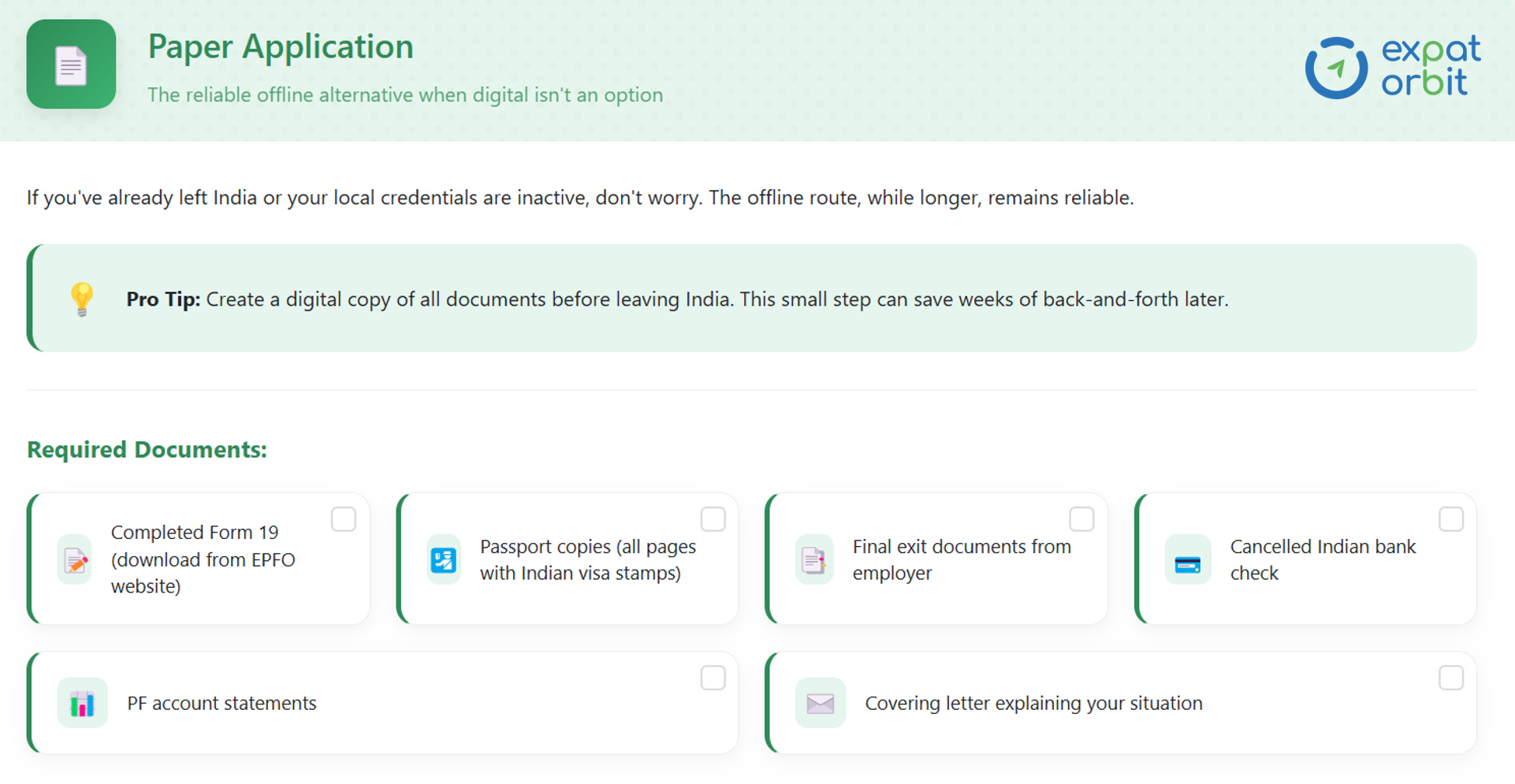

Option 2: Paper Application

Common Challenges and Solutions

Challenge 1: Inactive Indian Bank Account

Solution: Contact your Indian bank to request activation or unfreezing of your account. Alternatively, you may consider opening a new bank account or submitting your withdrawal application with a request to credit the PF amount directly to your overseas bank account.

Challenge 2: Lost Documentation

Solution: Coordinate with your former employer’s HR or admin team to retrieve any missing information or documents, as they may have these in their employee records.

Challenge 3: Employer No Longer Operational

Solution: If the employer is unavailable or the establishment is no longer operational, you may approach your bank for assistance with validation and attestation of the withdrawal application.

Frequently Asked Questions

Even when you understand the basics, it’s natural to have lingering questions. Common concerns among expatriates include:

- Can I withdraw my PF directly to my overseas bank account?

- Why is my PF application getting rejected?

- What should I do if my previous employer is unresponsive?

- Do I need to be physically in India to apply for PF withdrawal?

- How can I resolve discrepancies in my PF account?

Read what our client's say

"Never imagined my PF withdrawal from India would be so complicated—multiple account transfers, new rules like Aadhaar & UAN, and a closed bank account made it feel impossible. But Expat Orbit made it happen. From opening a virtual bank account to coordinating with my old employer and consolidating my PF, their team handled everything. I finally received my PF after years of uncertainty. Highly recommend them to any expat facing similar issues!"

- Theodor Rudiferia, Executive Chef, Bahrain

Need Personal Assistance?

Every expatriate's situation is unique. Whether you're in Tokyo or Toronto, we're here to help you navigate your PF withdrawal journey. Our team has helped professionals from 30+ countries successfully recover their PF savings.

📧 Contact us: [email protected] 📱 Schedule a consultation: Book Now

Last Updated: January 2025

Disclaimer: This guide is for informational purposes. Regulations may change. Please verify current requirements with EPFO.