Liaison Office Compliances in India: A Comprehensive Guide

Expanding business operations to a foreign country like India can be a lucrative endeavor for global businesses. One of the ways to establish a presence in India is through the setup of a Liaison Office (LO). A Liaison Office serves as a communication channel between the foreign enterprise's head office and entities in India, allowing the foreign company to gather market information, promote collaborations, and represent its interests in India.

While operating an LO in India offers several advantages, it also comes with a set of compliance requirements that foreign companies need to adhere to. In this comprehensive guide, we will delve into the various compliances that foreign companies must follow when operating an LO in India.

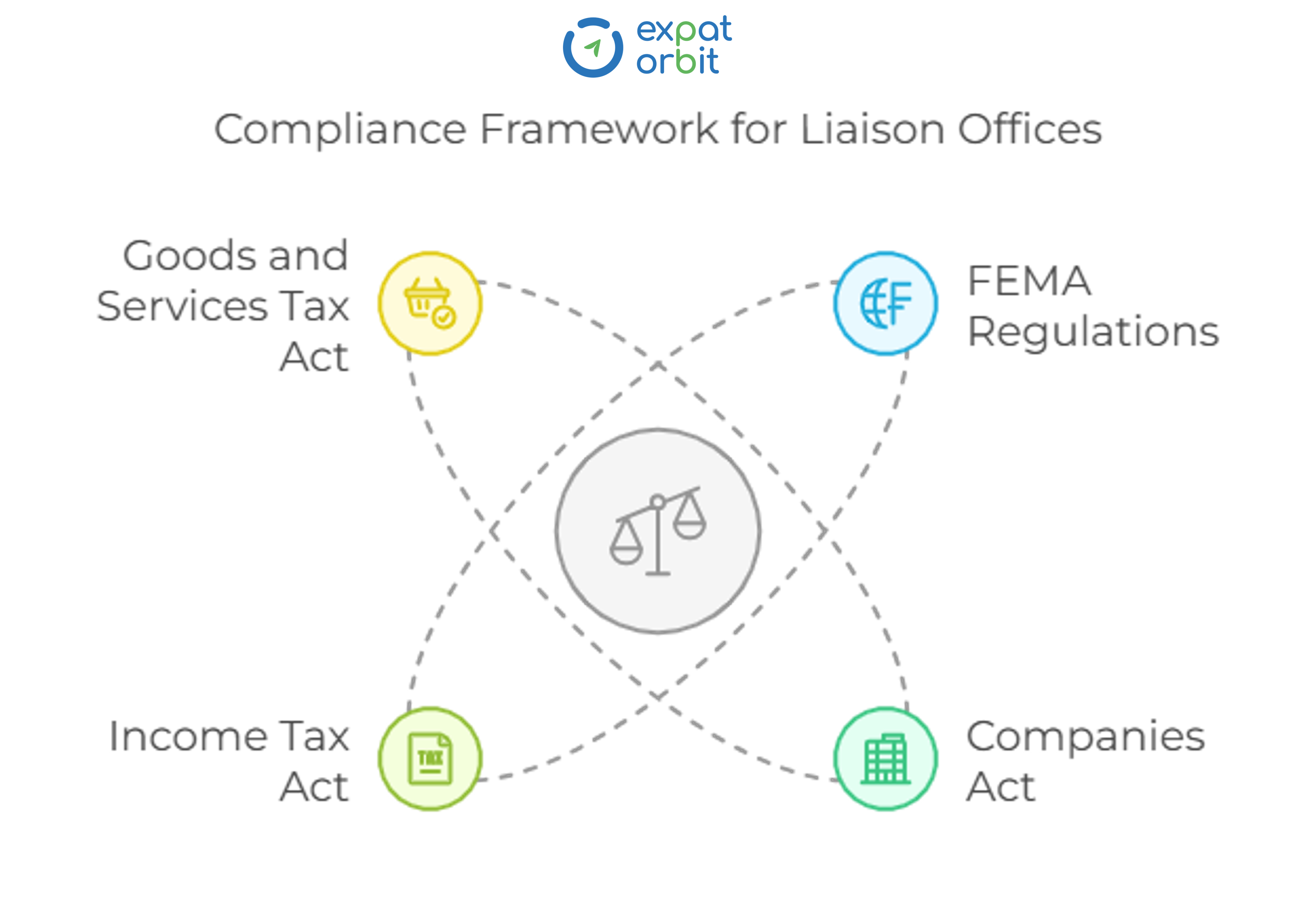

The compliance requirements for a liaison office can be segmented into four categories:

- Compliance under FEMA Regulations

- Compliance under Companies Act

- Compliance under Income Tax Act

- Compliance under Goods and Services Tax Ac

1. Compliance under FEMA Regulations

A. Foreign Liabilities and Assets (FLA) Return

Each Liaison Office must submit the FLA (Foreign Liabilities and Assets) return by July 15 each year, provided there are outstanding foreign assets or foreign liabilities as of the reporting date.

B. Annual Activity Certificate (AAC) and Audited Financial Statements

To ensure transparency and compliance, an LO is required to submit an Annual Activity Certificate (AAC) and audited financial statements. The AAC certifies that the LO has engaged only in the activities permitted by the Reserve Bank of India (RBI) and has complied with the terms and conditions specified in the approval letter.

The AAC as at 31st March, along with the audited balance sheet and the receipt and payment account, must be submitted on or before 30th September of every year to the designated Authorised Dealer (AD) Category - I Bank and the Directorate General of Income Tax (International Taxation), New Delhi. In case the annual accounts of the liaison office are finalized on any date other than 31st March, the submission deadline is within six months from the due date of the balance sheet.

2. Compliance under Companies Act

A. Registration with Ministry of Corporate Affairs - Form FC 1

Foreign companies setting up a Liaison Office (LO) in India must register with the Ministry of Corporate Affairs (MCA) by submitting Form FC-1 within 30 days of establishment. Key documents required to be submitted along with FC-1 include, certified copy of the company's charter, list of directors and secretaries, a power of attorney or board resolution for the authorised representative in India, a declaration certifying the absence of any legal disqualifications for the company's directors and the Indian representative, the full address of the company's principal or registered office and the full address of the office of the company in India which is deemed to be its principal place of business in India.

B. Preparing and Filing of Financial Statements - Form FC 3

Under the Companies Act, foreign companies operating an LO in India must prepare and file financial statements for their Indian business operations. A copy of financial statements shall be filed in Form FC 3 with the Registrar of Companies (ROC) within six months of the financial year-end. Along with the financial statements, a list of all places of business established by foreign company in India as on date of the balance sheet is submitted with the registrar.

C. Annual Return

In addition to Form FC 3, foreign companies operating an LO in India must file Form FC 4, which is the annual return of the company. This form needs to be filed within 60 days from the close of the financial year with the ROC.

D. Audit of accounts

Every foreign company is required to have its Liaison Office's accounts audited by a practicing Chartered Accountant in India, or by a firm or limited liability partnership consisting of practicing Chartered Accountants.

3. Compliance under Income Tax Act, 1961

A. Obtaining Permanent Account Number (PAN) and Filing of Income Tax Return

A Liaison Office is obligated to obtain a PAN (Permanent Account Number) from the Income Tax Authorities. Furthermore, a Liaison Office in India is subject to the requirement of filing an annual Income Tax return.

B. Annual Filing of Form 49C

Foreign companies running a Liaison Office (LO) in India must submit Form 49C with the Income-tax Authority by May 30th of each year. It provides information on various aspects, including details of agents / representatives / distributors, employees, receipts and expenses, and transactions with Indian parties.

C. Withholding Tax (WHT) Compliance

It is also crucial for a Liaison Office to comply with India's tax withholding requirements under the Income-tax Act, which includes deducting and depositing taxes on payments made to employees, vendors, or service providers as per the applicable tax rates.

4. Compliance under Goods and Services Tax Act

If a Liaison Office avails certain services in India, it may be subject to the Goods and Services Tax (GST) under the reverse tax mechanism. Compliance with GST obligations includes registration, filing of monthly/quarterly/annual returns, and payment of applicable taxes.

Overwhelming, is it?

Establishing a Liaison Office in India offers significant benefits for foreign companies looking to enter the Indian market, though compliance with the regulations set by the Reserve Bank of India (RBI), Income-tax Authority, Registrar of Companies (ROC), and other relevant authorities is crucial.

As an alternate strategy, many overseas companies, particularly post-COVID, are increasingly hiring remote talent for various roles through an Employer of Records (EOR). Read More.

EORs handle employee onboarding, payroll, and other administrative tasks, allowing companies to focus on core operations while maintaining control over their workforce. This approach reduces the complexity of compliance tasks and offers an efficient alternative to establishing a legal entity in India.

For further information on EOR services or assistance with Liaison Office compliance, reach out at [email protected]. Take the next step in expanding business operations in India with expert support and guidance.