Mitigating Risks for Business Travellers in India: A Guide to Compliance and Best Practices

India's business landscape is evolving rapidly, with a projected 7.6% annual growth in business travellers by 2032. This positions the country as a critical hub for international corporate activities, presenting both opportunities and challenges for global mobility professionals. As businesses deepens its roots in India, they face an intricate web of regulations, compliances and cultural nuances that can create significant risks if not adeptly managed.

Imagine this scenario: Your company has just launched a groundbreaking project in Bangalore, with a highly skilled expatriate seconded from the US entity leading the team on ground. The project is gaining momentum, and the global leadership team is impressed with the rapid progress. The situation takes an unexpected turn when the business visa extension being sought for the expat was denied after the authorities discovered that he was engaged in activities that aligned more closely with employment rather than permissible business visitor roles, raising questions about the appropriate visa category for his role. The project grinds to a halt, imperilling immediate deliverables as well as your company's strategic objectives in the region.

Common approach opted when seconding expats to India

Is this approach inherently wrong?

Not necessarily. This approach is appropriate for short business trips, such as attending meetings, participating in training programs, or similar activities. However, when the purpose of the visit doesn’t match the visa category, it can create significant compliance challenges. These challenges aren’t limited to visa issues—they often extend to taxation and social security obligations, exposing both the expatriate and the host company to legal and financial risks.

In this article, we’ll break down common myths and misconceptions about business travellers in India, helping you understand and navigate these complexities effectively.

Debunking Common Myths

Myth 1: Short-term trips to India only require a business visa

It is often believed in the global mobility circle that any short-term visit to India can be covered by a business visa. Many assume that as long as the expatriate’s stay is brief, a business visa or e-business visa is sufficient. However, this oversimplification can often lead to compliance risks.

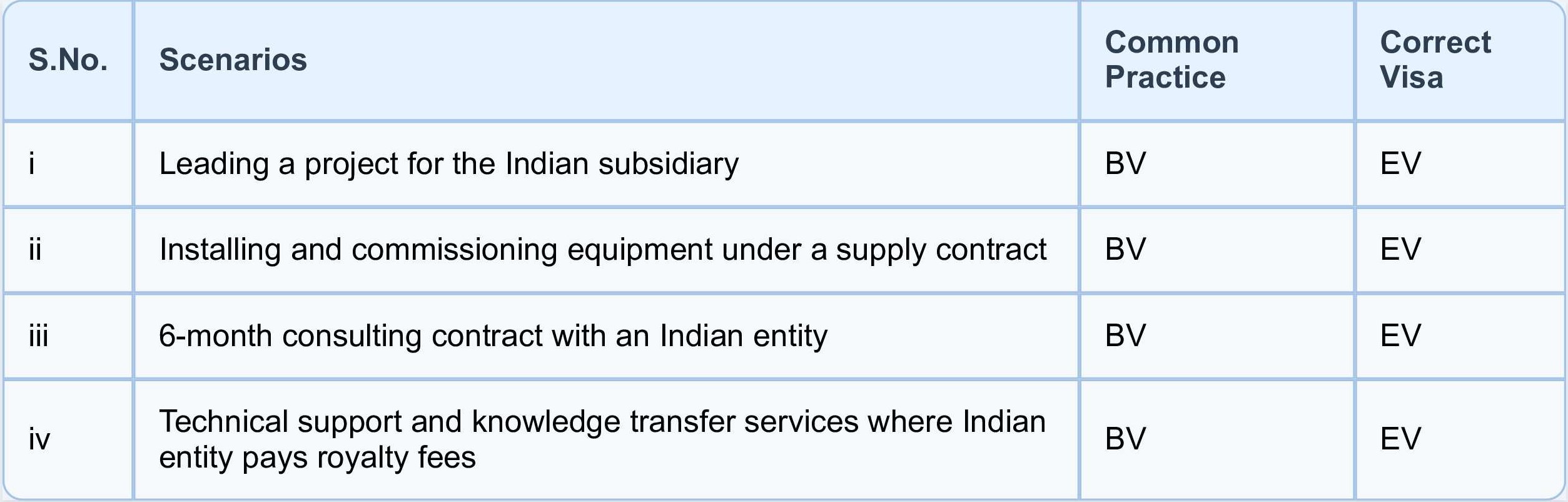

Consider these scenarios that frequently result in visa misclassification:

Understanding the difference between business and employment visas is key. When an expat is involved in managing, executing, or significantly contributing to a company’s operations, an employment visa is the right choice.

It’s not just about how long the expat stays—it’s about their role and the nature of their involvement. Choosing the correct visa category is crucial for staying compliant.

Myth 2: Foreign nationals staying in India less than 183 days are not taxable in India

One of the most common misconceptions among companies and expatriates is that foreign nationals staying in India for less than 183 days in a financial year are automatically exempt from Indian taxation. This assumption has often led to neglected tax obligations, particularly for those on business visas, resulting in serious non-compliance with local tax and labor laws.

To break down this myth, let’s look closer at the '183 days' rule:

Indian tax law specifies that any income earned or sourced in India is taxable in India. However, expatriate assignments often have a global dimension, where income can become taxable both in India and in the individual’s home country, creating a risk of double taxation.

To address this, India has entered into Double Taxation Avoidance Agreements (DTAAs) with various countries. These agreements include a provision for short-stay exemption, forming the basis of the '183 days' concept. However, it’s important to note that this exemption is not automatic and applies only if all of the following conditions are met:

- The expatriate’s stay in India during the year does not exceed 183 days, AND

- The expatriate is paid by, or on behalf of, an employer who is not a resident of India, AND

- The remuneration is not borne by a permanent establishment of the employer in India.

Only when all these conditions are fulfilled can an expatriate qualify for the short-stay exemption. However, the details vary with each DTAA, as they depend on the specific wording of clauses and how the stay days are calculated.

To learn more about the 183-days rule, click here.

Myth 3: Business Travellers are not required to File an Indian Tax Return

Business travellers are often thought to be exempt from filing an Indian tax return, as their remuneration is typically paid in their home country. However, it is important to understand that any income earned for services rendered in India is deemed to accrue in India and is therefore taxable, regardless of where the payment is received.

Let’s consider two scenarios to clarify this:

Scenario 1: Short-Term Business Trip

A UK expat travels to India for a 3-month project to oversee business operations for an Indian entity. Since the remuneration is paid in the UK, the stay in India is less than 183 days, and the payroll cost is not cross-charged to the Indian entity, the expat may qualify for a short-stay exemption. However, even in such cases, the expat must file an Indian tax return to report the exemption being availed.

Scenario 2: Stay Exceeding 183 Days

Consider a US expat in India on a project, staying over 200 days during the financial year. Although his remuneration is paid in the US, he becomes ineligible for the short-stay exemption as his stay exceeds 183 days. This requires him to file an Indian tax return and report the income related to the Indian project for taxation in India.

Myth 4: Business Travellers do not need to comply with registration requirements with local authorities.

Contrary to common belief, foreign nationals on short business visits to India may still need to comply with local registration requirements, even for brief stays. Two critical compliance requirements that can affect business travel are Foreigners Regional Registration Office (FRRO) registration and Permanent Account Number (PAN) registration.

- FRRO Registration:Employment visa holders must register with the FRRO within 14 days of arrival. Similarly, business visa holders are required to register if their stay exceeds 180 days. The specific registration requirement depends on the visa endorsement, which may specify registration based on either the aggregate stay during a calendar year or continuous stay duration.

- Registration with Income Tax Authorities (PAN):PAN registration is often overlooked, especially when Indian entities do not exercise withholding compliance for foreign expats. However, if an expatriate is required to file a tax return in India, obtaining a PAN becomes mandatory as part of the process.

Myth 5: Provident Fund (PF) Compliance is not required for Business Travellers

A significant compliance aspect that often surprises organisations is the Provident Fund (PF) requirement for business travellers in India. It is assumed that business visa holders are automatically exempt from PF obligations.

However, a visa category does not absolve an employer of their responsibilities toward employees. The applicability of PF compliance is based on the substance of the relationship, not solely on the visa category. If an Indian entity functions as the de facto employer of an expatriate, PF compliance obligations may apply, regardless of the expat’s visa status.

Key Takeaways

With the digitisation of government systems and enhanced inter-departmental data-sharing, immigration, tax, and provident fund authorities in India can now seamlessly cross-reference records to assess compliance. For instance, during employment visa applications, the PF establishment code of the host entity in India is captured and reported. This enables PF authorities to monitor expatriates' presence at the host entity and evaluate whether the necessary compliances related to expatriates are being fulfilled.

The consequences of mismanaging these requirements extend far beyond immediate operational disruptions—they can damage an organisation's reputation and expose it to significant penalties and legal liabilities. Therefore, organisations must address these often-overlooked aspects of business travellers and ensure full compliance as part of their broader operational strategy.

Expat Orbit Support

Understanding and implementing the right compliance framework for business travellers in India creates a strong foundation for successful international operations. At Expat Orbit, we understand the nuances of Indian immigration regulations and work alongside organisations to develop efficient mobility strategies. Our experienced team provides comprehensive solutions that align with your business objectives while ensuring adherence to local requirements - from visa classifications to tax obligations and statutory registrations.

Ready to strengthen your mobility program? Connect with our mobility experts to discuss your specific needs and develop an effective strategy for your expatriate assignments in India. Contact us at [email protected] or schedule your personalised consultation here.