NRI Bank Accounts in India: Complete Guide to NRE, NRO, FCNR, SNRR & Escrow Accounts (2025)

If you’re a Non-Resident Indian (NRI), Person of Indian Origin (PIO), or Overseas Citizen of India (OCI) living or working abroad, managing your finances between your resident country and India can feel complicated. Whether it’s sending funds home, saving, investing, or managing income earned in India, cross-border financial transactions often involve regulatory rules and compliance requirements.

To simplify this, the Reserve Bank of India (RBI) permits NRIs, PIOs, and OCIs to open special categories of bank accounts in India. These accounts comply with Foreign Exchange Management Act (FEMA) regulations and are specifically designed to help you legally and efficiently manage your Indian earnings, investments, and savings while staying compliant with Indian exchange control laws.

Summary

What is an NRI Account?

An NRI account is a bank account that NRIs, PIOs, and OCIs can open and maintain with Indian banks. These accounts allow you to hold and manage funds in Indian Rupees (INR) or foreign currency, depending on the type of account. They are essential for repatriating money, managing financial transactions, and handling investments in India in a seamless and compliant manner.

1. Non-Resident (External) Rupee Account [NRE Account]

The NRE Account is the most widely used type of NRI bank account. It allows you to deposit your foreign income, which is then converted into INR at the prevailing exchange rate.

Key Features:

- Maintained in Indian Rupees (INR)

- Both principal and interest are fully repatriable

- Can be opened as Savings, Current, Recurring Deposit, or Fixed Deposit

- Interest earned is tax-free in India for non-residents

- Ideal for managing overseas income and Indian expenses

Example: If you work in the U.S. and remit funds to India for family expenses or savings, an NRE account is suitable.

2. Foreign Currency Non-Resident (Bank) [FCNR (B)] Account

An FCNR (B) account is ideal for NRIs who prefer to maintain their savings in foreign currency without converting them into Indian Rupees.

Key Features:

- Deposits maintained in major global currencies like USD, GBP, EUR, AUD, etc.

- Protects your savings from foreign exchange fluctuations

- Principal and interest are fully repatriable

- Interest earned is exempt from Indian income tax

- Can be opened only as term deposits with maturity of up to five years

This account is a good choice if you want to safeguard your money against currency risks while planning to return to India in the future.

3. Non-Resident Ordinary Rupee (NRO) Account

An NRO account is meant for NRIs who need to manage their income earned in India, such as rent, dividends, pension, or proceeds from property.

Key Features:

- Maintained in Indian Rupees (INR)

- Available as Savings, Current, Recurring, or Fixed Deposit

- Accepts both Indian and foreign currency deposits

- Funds can be repatriated up to USD 1 million per financial year, subject to applicable taxes

- Interest earned is taxable in India

- Can be held jointly with residents on a 'former or survivor' basis; can also be held jointly with NRIs or PIOs

Ideal for managing income generated from assets or investments in India.

4. Special Non-Resident Rupee Account (SNRR)

An SNRR account is designed for non-residents who have business or commercial dealings with India. It functions like a non-interest-bearing current account.

You can use the SNRR account for transactions related to trade, investments, or project payments. Non-residents may also use this account to receive tax refunds or withdraw provident fund amounts. Any such funds must be repatriated abroad, as they cannot be used for local spending within India.

5. Escrow Account

An escrow account is a secure bank account where funds are held by a neutral third party until specific conditions of a major regulated transaction are fulfilled. These accounts are used by NRIs, residents, and businesses for activities such as property purchases, share transfers, or merger and acquisition transactions.

Escrow accounts do not earn interest and are primarily used to ensure that funds are released only after all agreed terms are met.

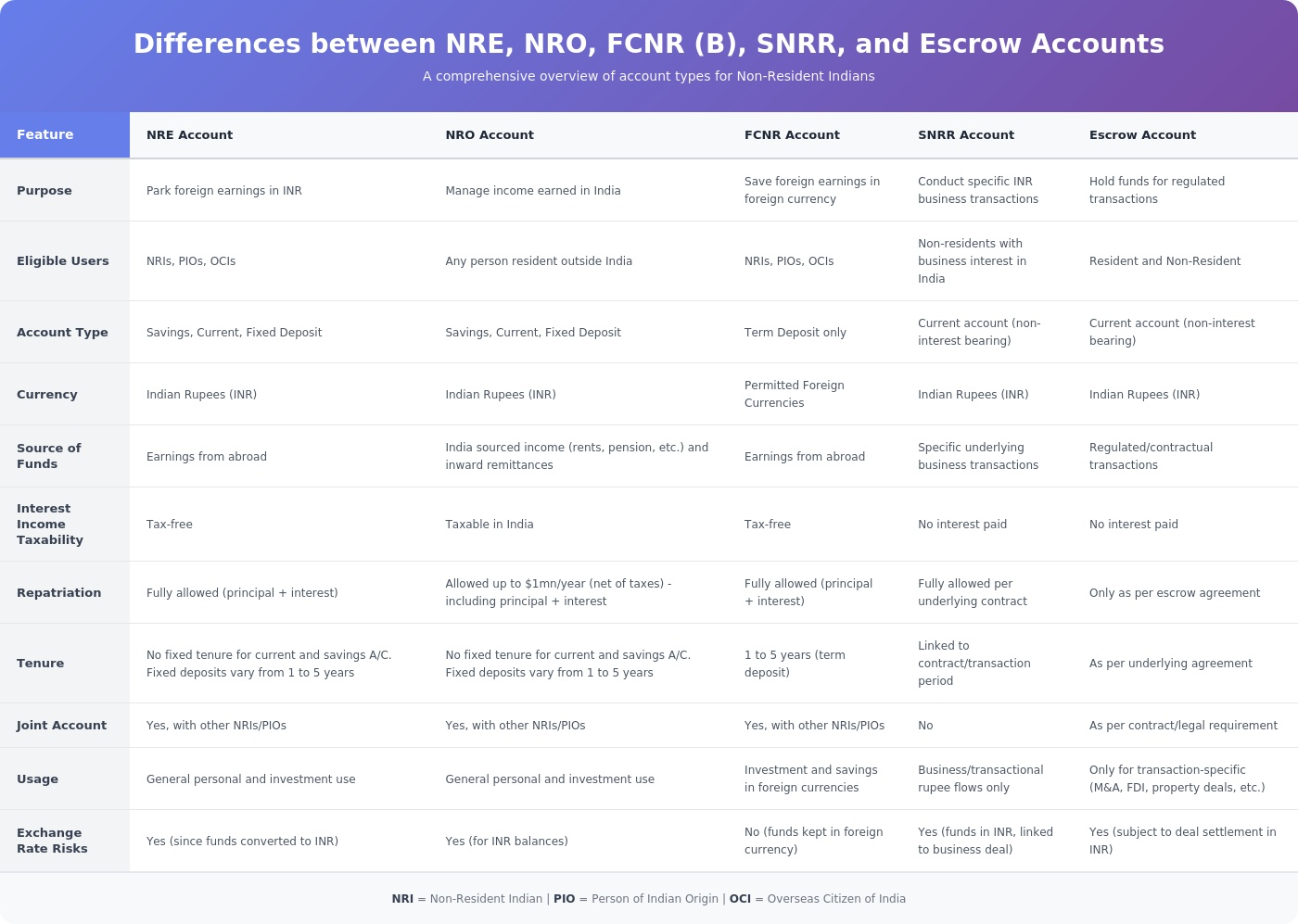

A comprehensive overview of account types for Non-Resident Indians

General Documents Required to Open Any NRI Account

Most Indian banks require the following documents:

- Passport copy

- Valid visa or residence permit

- Overseas address proof

- Recent passport-size photographs

- PAN card or Form 60 (if PAN is not available)

- Additional documents such as OCI/PIO card or FATCA declarations depending on the bank and jurisdiction

You can apply online or through overseas branches of major Indian banks like SBI, ICICI Bank, HDFC Bank, and others.

Conclusion

Understanding the features and differences between NRE, NRO, FCNR (B), SNRR, and Escrow accounts helps you choose the right option for your personal or business needs. Staying compliant with FEMA, RBI regulations, tax rules, and repatriation limits ensures smooth financial management and avoids legal issues.

For expert support on NRI taxation, FEMA compliance, or account opening, you can contact Expat Orbit. We assist NRIs, expatriates, and global companies in managing tax and regulatory requirements with clarity and confidence.